Erhebung des Lernstandes

Zu den Auswertungen

Gespräch vereinbaren

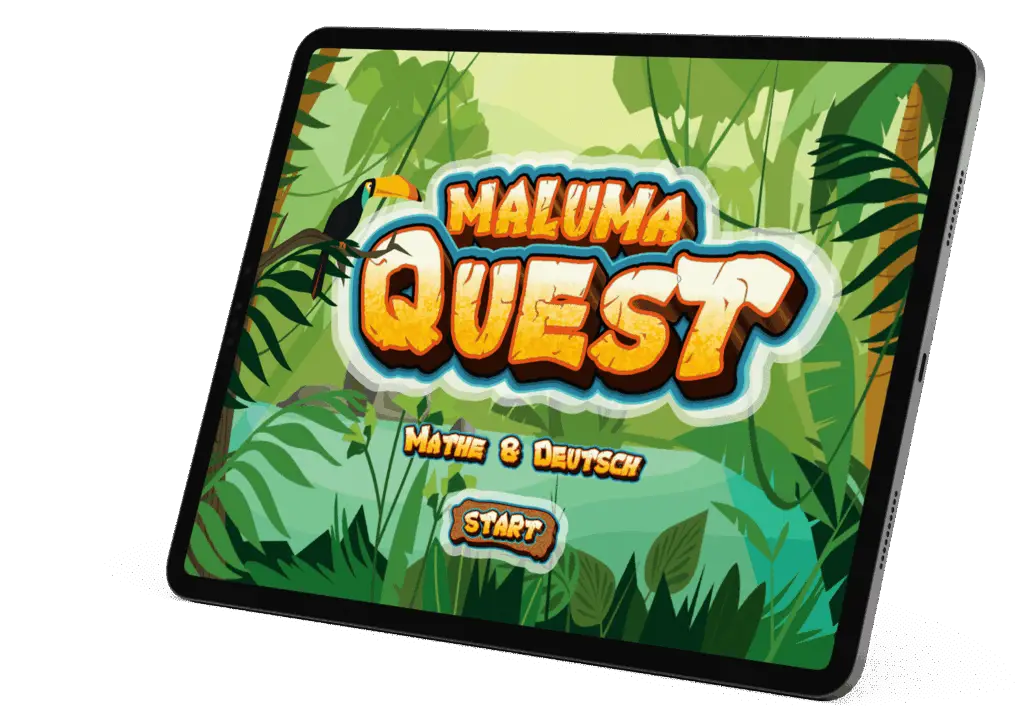

Spielerisch,

unterhaltsam und

einfach durchzuführen

Der Lernstand jedes Kindes wird spielerisch erfasst und sorgt dabei für Spaß und Motivation.

Assets

Learn more

Assets under management

$28.90M

Professionals

120+

Earning client trust since

2016

LERNSTANDSERHEBUNG

Die Maluma-Lernstandserhebung soll Kindern Spaß machen .

Das macht es nicht nur Lehrpersonen einfacher, regelmäßig mit den Kindern Erhebungen durchzuführen, sondern mac ht auch die Resultate wertvoller, weil Kinder nicht aus Langeweile nicht ihr Bestes gegeben haben.

Learn More

Our Philosophy

Maluma-Erhebung

Lernstand in Mathe und Deutsch

Die Maluma-Lernstandserhebung in Deutsch und Mathe orientiert sich an den Rahmenlehrplänen der Bundesländern sowie den Vorgaben der KMK.

Die Erhebungen können auch Hinweise auf Beeinträchtugungen wie LRS, Dyskalkulie usw. geben.

Services

Covering the Full Spectrum of Global Financial Services

Financial

Planing

Investment Management

Insurance & Risk Management

Alternative Investments

Brauchbare Resultate

“Nicht noch eine Erhebung” – Sondern die einzige, Spaß und Sinn macht

Deutsch und Mathe

Der Lernstand kann sowohl für Deutsch als auch für Mathe erhiben werden. Weitere Fächer kommen mit der Zeit hinzu. Es wird unterschieden zwischen Basis- und Optimalkompetenzen.

2. – 5. Klasse

Die Erhebung ist derzeit ausgelegt auf die 2. bis 5. Klasse. Im Laufe des Schuljahres 2025/2026 kommen die restichen Primarstufen hinzu.

Rahmenlehrplan

Die Erhebung orientiert sich sowohl an den Rahmenlehrplänen der Bundesländer, als auch an den Klassenstufen. Dabei wird ein Schwerpunkt auf Basiskompetenzen gelegt.

Max. 1 Schulstunde

Die Erhebung ist so strukturiert, dass sie inkl. Ausgabe von Tablets, Anmelden sowie Rückgabe der Tablets innerhalb einer Schulstunde durchgeführt werden kann.

Why us?

You’ll Know What

You’re Getting

Builds Wealth

Steps to Take Next

We are Transparent Like that. No Gimmicks.

Schedule a Call

Our team

Choosing The Right

Financial Planning Team

Careers

View All

Trusted partner

SEC Registered Investment Advisor

We help you achieve your vision and cultivate confidence and peace of mind across your financial journey.

Free Consultation

Testimonials

Client Experiences That Speak for Themselves

4.9

Google reviews

“Finovate has been instrumental in our growth. Their team took the time to truly understand our needs and helped us eliminate inefficiencies.”

Carlos Martines

MEX – CEO

“Partnering with Finovate was a game-changer for us. They took the time to understand our challenges and helped us streamline our operations for success.”

Kate Smith

Swirl – CEO & President

“I hired Finovate for a small project & was very happy. He not only answered all my questions, but he didn’t treat me like a “small project”.

I was very satisfied & would recommend.”

Rebecca Roy

H&N – CEO & President

“Finovate has been instrumental in our growth. Their team took the time to truly understand our needs and helped us eliminate inefficiencies.”

Carlos Martines

MEX – CEO

“Partnering with Finovate was a game-changer for us. They took the time to understand our challenges and helped us streamline our operations for success.”

Kate Smith

Swirl – CEO & President

“I hired Finovate for a small project & was very happy. He not only answered all my questions, but he didn’t treat me like a “small project”.

I was very satisfied & would recommend.”

Rebecca Roy

H&N – CEO & President

Insights

Hear Directly

From Finovate Experts

More Insights

FAQ

Häufige Fragen und Antworten

Gerne beantworten wir alle Ihre Fragen in einem persönlichen Gespräch.

Für welche Klassenstufen werden die Lernstanderhebungen angeboten?

A solid financial plan ought to cover a thorough look at your personal goals and aspirations, alongside an evaluation of your investment holdings. It should map out your expected income and expenses both before and after retirement, weigh the pros and cons of different retirement and investment account options, and outline strategies for retirement preparation, tax efficiency, charitable contributions, and safeguarding your assets through insurance.

On top of that, it should offer clear, actionable advice and steps to turn your goals into reality. To guide you toward the best decisions, a good plan will also lay out a variety of potential scenarios—plus some alternative ones—for you to consider.

Wenn man wiederholt Erhebungen durchführt, bauen diese auf einander auf?

Retirement age varies widely from person to person. The big question is whether you’ve got enough saved up to support the lifestyle you’re aiming for, especially since retirement could stretch on for 30 years or longer. Your income during those years will likely come from a mix of sources: retirement accounts and savings, a pension if you have one, brokerage accounts, Social Security payments, annuity income if you’ve set that up, and any other investments you’ve built over time.

Für welche Fächer gibt es die Erhebungen?

We base our investment approach on evidence and decades of market history, not guesswork about the future. Research shows market timing doesn’t work. Instead, we focus on what you can control: risk, asset allocation, costs, and taxes. Emotional decisions often hurt long-term returns, so we aim to avoid those pitfalls.

Diversification lowers risk—not just by holding many assets, but by mixing company sizes, sectors, and balancing stocks and bonds. Risk can’t be erased, but it can be managed.

We keep expenses low with cost-effective mutual funds and ETFs, since high fees can erode even a well-diversified portfolio’s gains.

Taxes matter too. While unavoidable, they can be minimized with a smart, tax-aware strategy.

Wie lange dauern die Erhebungen

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.

Welche Infrastruktur/Geräte werden für die Erhebung benötigt?

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.

Muss jedes Kind ein Tablet haben für die Erhebung?

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.

Kann man die Erhebung mit einer Klasse testen?

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.

A solid financial plan ought to cover a thorough look at your personal goals and aspirations, alongside an evaluation of your investment holdings. It should map out your expected income and expenses both before and after retirement, weigh the pros and cons of different retirement and investment account options, and outline strategies for retirement preparation, tax efficiency, charitable contributions, and safeguarding your assets through insurance.

On top of that, it should offer clear, actionable advice and steps to turn your goals into reality. To guide you toward the best decisions, a good plan will also lay out a variety of potential scenarios—plus some alternative ones—for you to consider.

Retirement age varies widely from person to person. The big question is whether you’ve got enough saved up to support the lifestyle you’re aiming for, especially since retirement could stretch on for 30 years or longer. Your income during those years will likely come from a mix of sources: retirement accounts and savings, a pension if you have one, brokerage accounts, Social Security payments, annuity income if you’ve set that up, and any other investments you’ve built over time.

We base our investment approach on evidence and decades of market history, not guesswork about the future. Research shows market timing doesn’t work. Instead, we focus on what you can control: risk, asset allocation, costs, and taxes. Emotional decisions often hurt long-term returns, so we aim to avoid those pitfalls.

Diversification lowers risk—not just by holding many assets, but by mixing company sizes, sectors, and balancing stocks and bonds. Risk can’t be erased, but it can be managed.

We keep expenses low with cost-effective mutual funds and ETFs, since high fees can erode even a well-diversified portfolio’s gains.

Taxes matter too. While unavoidable, they can be minimized with a smart, tax-aware strategy.

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.